BLACKROCK CEO SAYS HYDROGEN WILL CREATE THE NEXT CLASS OF UNICORNS

Not Financial Advice. Do your Due Diligence. We are a shareholder, paid and therefore biased. We like the stock.

The rapid advancement of artificial intelligence (AI) is significantly increasing the energy demands of data centers worldwide. Goldman Sachs Research estimates that by 2028, AI could account for approximately 19% of data center power consumption, adding about 200 terawatt-hours annually between 2023 and 2030.

This surge in energy requirements presents a critical challenge, especially as traditional power grids face constraints and environmental concerns intensify. Hydrogen emerges as a compelling solution to this dilemma. Its potential as a clean, efficient energy source is gaining attention, with companies like Microsoft exploring hydrogen fuel cells for backup power in data centers.

By integrating hydrogen into their energy strategies, data centers can reduce reliance on fossil fuels, enhance energy resilience, and align with global sustainability goals. This convergence of AI growth and the need for sustainable power solutions positions hydrogen as a promising investment opportunity in the evolving energy landscape.

Larry Fink, CEO of BlackRock, was quoted supporting hydrogen stating:

"It is my belief that the next 1,000 unicorns won't be a search engine, won't be a media company, they'll be businesses developing green hydrogen, green agriculture, green steel and green cement."

INTRODUCING RED METAL RESOURCES (CSE:RMES) (OTC:RMESF)

The company today announced:

RED METAL RESOURCES PLANNING 2025 WORK PROGRAM ON 100% OWNED HYDROGEN-PROSPECTIVE MINERAL CLAIM PACKAGE SPANNING QUEBEC AND ONTARIO

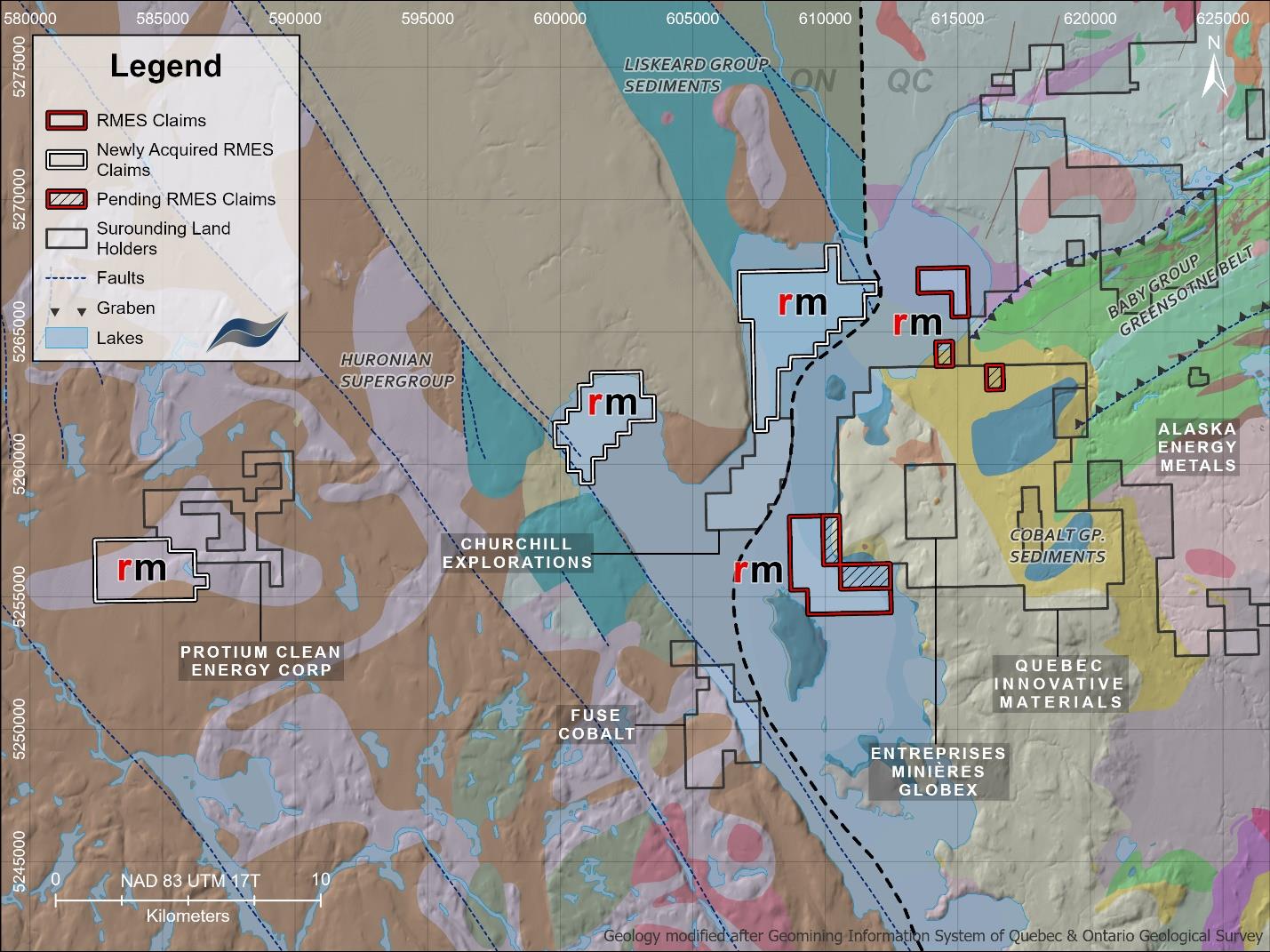

Red Metal Resources Ltd. is planning a phase 1 work program and data compilation for its recently acquired, 100-per-cent-owned, portfolio of highly prospective mineral claims and mineral claim applications, consisting of seven separate claim packages, covering 172 mineral claims and totalling over 4,546 hectares.

These highly prospective claim packages are located to the north, northeast and the southwest of Quebec Innovative Materials Corp.'s recent hydrogen-in-soil discovery in the Saint-Bruno-de-Guigues area, of over 1,000 parts per million, announced on Sept. 4, 2024, as well as covering similar geology to the west located in the Larder Lake mining district of Ontario, along the Quebec border near the town of Ville-Marie, Que.

These claim blocks are contiguous on three sides to Quebec Innovative Materials (CSE:QIMC) and cover possible extensions in multiple directions. To date, 164 of the 172 claims have been approved by the Quebec Ministry of Natural Resources and Forests and the Ontario Ministry of Mines.

This news release contains information about adjacent properties on which the Company has no right to explore or mine. Investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on the Company's properties.

Geologic or white hydrogen offers a clean, renewable and potentially abundant source of energy with a range of environmental and economic benefits. Its carbon-free nature, high energy density and compatibility with existing infrastructure make it a promising solution for meeting future energy needs and achieving global climate goals.

RED METAL RESOURCES (CSE:RMES) (OTC:RMESF) president and chief executive officer Caitlin Jeffs stated: "We have established a significant and highly prospective claim package covering 172 mineral claims and totalling over 4,546 hectares to the north, northeast and the southwest of Quebec Innovative Materials Corp.'s recent hydrogen-in-soil discovery in both Quebec and directly across the border in Ontario. Red Metal is actively planning a phase 1 work program to encompass its Quebec and Ontario claims and highlight the potential for new discoveries of hydrogen as well as base and precious metals as we continue to advance our Carrizal copper/gold property in Cordillera, Chile."

Red Metal Resources is planning an initial exploration program that could include, but is not limited to:

- Gas sampling from the soil and underwater surveys in Timiskaming Lake; these surveys can be used to locate degassing zones associated with faults in the Timiskaming rift;

- Gravimetry and audiomagnetotellurism (AMT) geophysics to assess variations in the thickness of local sedimentary rock deposits (gravity troughs) over the Archean basement; AMT data will assist in locating graben-related faults in the Saint-Bruno-de-Guigue area that are covered by quaternary sediments;

- Regional remote sensing gas surveys to identify specific targets to provide useful remote sensing data for hydrogen and helium exploration.

See Press release here: https://redmetalresources.com/news/red-metal-resources-planning-2025-work-program-on-100-owned-hydrogen-prospective-mineral-claim-package-spanning-quebec-and-ontario

With the largest money manager in the World's CEO, Larry Fink of BlackRock, making outlandish comments like the next 1,000 unicorns will come from Hydrogen now may be the time to add companies like RED METAL RESOURCES (CSE:RMES) (OTC:RMESF) to your watch list.

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Free Market Media ("FreeMarket") was paid a fee by Digital Assets Corp. There may be 3rd parties who may have shares of Digital Assets Corp. and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of Free Market owns shares of Digital Assets Corp. FreeMarket reserves the right to buy and sell, and will buy and sell shares of Digital Assets Corp. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by FreeMarket has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of your investment.

i - Goldman Sachs Research: The AI Revolution and its Impact (PDF)

ii - Microsoft exploring hydrogen fuel cells for data centers

iii - Red Metal Resources Press Release