Klaus Vedfelt

|

Manager perspective and outlook

- Third quarter performance was strong across the global mid and small-cap universe. The MSCI ACWI SMID Cap Index had positive returns in 10 of 11 sectors, with seven having double-digit returns. Only energy declined.

- Non-US equities outperformed the US, with the MSCI ACWI ex US Index topping the S&P 500 Index. Small and mid-caps outperformed globally, as we’d expect in the early stages of an interest rate cutting cycle. Market breadth expanded in the US and across the world. September returns for mega-cap bellwethers such as NVIDIA and Apple (not fund holdings) were negative, while the broader market was solid. This pattern is familiar to us. When growth picks up more broadly, the incentive to pay a steep premium to acquire future cash flow streams diminishes.

- China has had a difficult two years since the end of COVID lockdowns. Fiscal stimulus announced during the quarter should in our view boost its economy. Europe’s industrial base may get some much-needed benefit from China’s actions, which may filter into market sentiment.

- We believe that, on balance, inflation will not return to pre-COVID levels and global growth will be good to improving. That may foster a rebound in cyclical stocks but one more muted than the 2020 recovery. US GDP growth is likely to remain rather good, enough to sustain a fairly strong labor backdrop. We believe equities remain broadly preferable to bonds.

Portfolio positioning

|

Top issuers (% of total net assets) |

||

|

Fund |

Index |

|

|

Jack Henry & Associates Inc (JKHY) |

3.00 |

0.06 |

|

SEI Investments Co (SEIC) |

2.73 |

0.04 |

|

Advanced Micro Devices Inc (AMD) |

2.70 |

0.00 |

|

Exponent Inc (EXPO) |

2.43 |

0.03 |

|

Manhattan Associates Inc (MANH) |

2.36 |

0.08 |

|

Carl Zeiss Meditec AG (OTCPK:CZMWF) |

2.13 |

0.01 |

|

WEG SA (OTCPK:WEGZY) |

2.13 |

0.00 |

|

MarketAxess Holdings Inc (MKTX) |

2.07 |

0.04 |

|

Sysmex Corp (OTCPK:SSMXF) |

2.07 |

0.05 |

|

Pool Corp (POOL) |

2.02 |

0.07 |

|

As of 09/30/24. Holdings are subject to change and are not buy/sell recommendations. |

||

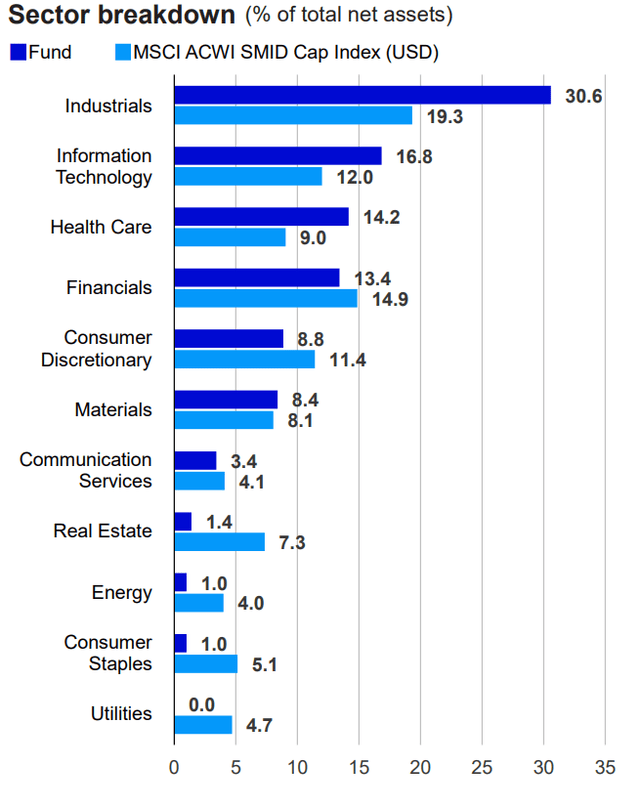

The fund’s most sizable exposures are in industrials, information technology, health care, financials, consumer discretionary and materials. Collectively, these represent over 90% of the portfolio. Industrials are the largest overweight relative to the index and real estate is its largest underweight.

At quarter end, the fund held 79 individual positions, with just a single position each in energy and consumer staples and only two positions in the real estate sector. The fund’s cash weight was less than 1%.

We remain positive on prospects for the fund’s holdings. Most provide key products or services to other businesses and have what we consider significant recurring revenue streams. We believe strong balance sheets, which is a key ownership criterion for us, greatly diminishes the financial risk of owning them. The economic environment has in our observation cooled this year, allowing inflation to recede enough that central banks have been lowering interest rates.

Performance highlights

|

Top contributors (%) |

||

|

Issuer |

Return |

Contrib. to return |

|

BayCurrent, Inc. (OTCPK:BYCRF) |

83.23 |

0.67 |

|

WEG S.A. |

32.31 |

0.56 |

|

MarketAxess Holdings Inc. |

28.17 |

0.53 |

|

Nomura Research Institute, Ltd. (OTCPK:NURAF) |

32.64 |

0.48 |

|

Exponent, Inc. |

21.53 |

0.44 |

|

Top detractors (%) |

||

|

Issuer |

Return |

Contrib. to return |

|

DISCO Corporation (OTCPK:DISPF) |

-30.32 |

-0.84 |

|

QUALCOMM Incorporated (QCOM) |

-14.18 |

-0.25 |

|

Cognex Corporation (CGNX) |

-13.22 |

-0.14 |

|

Toro Company (TTC) |

-6.87 |

-0.10 |

|

Auction Technology Group plc (OTCPK:ATHGF) |

-11.41 |

-0.10 |

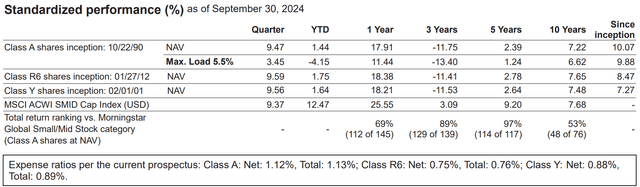

In the third quarter, the fund outperformed in seven of the 11 GICs sectors in the MSCI ACWI SMID Index, which was enough to offset underperformance in the information technology, real estate, consumer discretionary and utilities sectors.

Contributors to performance

BayCurrent is a Japan-based provider of consulting services primarily related to IT and systems integration. First half earnings were negatively affected by the timing of certain client projects. That has resolved and investor confidence has seemingly returned. BayCurrent has recorded revenue growth of better than 10% in nine of its 10 years as a public company.

WEG is a Brazil-based global producer of industrial machinery. The company has grown organically and via acquisition and has benefited from expanding use of electric components across industries.

MarketAxess operates an electronic multi-dealer platform primarily for trading US and European high grade corporate bonds. This year has been better after 2023’s rise in interest rates curtailed corporate debt issuance. That has been reversing.

Nomura Research Institute is an IT consulting company in Japan. Earnings momentum has been noteworthy as the company assists in digitizing Japanese banks and financial institutions.

Exponent is a consulting firm focused on science and engineering. It has benefited from the growing complexity of science and technology and by rising societal demand for health and safety. Recent results have been better than expected.

Detractors from performance

Disco makes precision cutting and grinding equipment used to produce semiconductors. Aside from sales related to artificial intelligence, semiconductor sales had been weak, though they have begun in our observation to show life.

Qualcomm is a dominant global player in modem chips for mobile devices. Apple’s weakness has seemingly weighed on the company, as did rumors it was interested in buying Intel (not a fund holding).

Cognex makes machine vision systems used in manufacturing and quality control functions. The company reported second quarter earnings above expectations, but management’s guidance indicated little expectation for a second half resurgence.

Toro designs and manufactures turf equipment, snow and ice removal and irrigation systems. Golf’s rising popularity and infrastructure spending are in our view long-term positives for the company. However, the environment for consumer sales has been slower, causing a temporary of inventory build-up, that appears to have been working its way down.

Auction Technology operates an online auction business connecting bidders from 65 countries to US and UK auction houses, mainly for sales of art and antiques as well as commercial and industrial equipment. The latter has lately been weak, which has driven down the share price, but the price decline appears excessive, in our view.