koto_feja

|

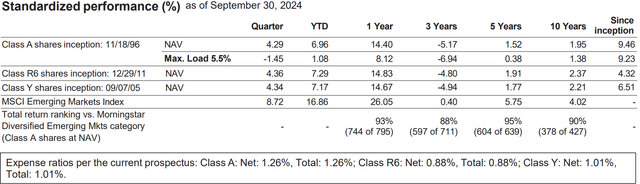

Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit invesco.com for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Returns less than one year are cumulative; all others are annualized. As the result of a reorganization on May 24, 2019, the returns of the fund for periods on or prior to May 24, 2019 reflect performance of the Oppenheimer predecessor fund. Share class returns will differ from the predecessor fund due to a change in expenses and sales charges. Index source: RIMES Technologies Corp. Had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. Performance shown at NAV does not include the applicable front-end sales charge, which would have reduced the performance. Class Y and R6 shares have no sales charge; therefore performance is at NAV. Class Y shares are available only to certain investors. Class R6 shares are closed to most investors. Please see the prospectus for more details. |

Manager perspective and outlook

- Emerging market equities delivered positive results and outperformed US, developed market and global equities. The last two quarters marked six consecutive months of outperformance. Recent developments in our view also bode well for emerging market equities.

- For the past few years, emerging market results have been “all about India,” a refuge for emerging market and global investors amid considerable uncertainty. Finally, the third quarter brought positive signs for broader emerging markets, including the first US Federal Reserve rate cut since 2020 and China’s more decisive economic stimulus, which spurred gains in Chinese equities.

- The big story, in our view, is the potential for emerging market equities to broadly outperform developed markets. With the lifting of the two clouds lingering over the asset class – US interest rates and China’s sluggishness – we think it’s time to get excited about emerging market equities.

- We believe four structural trends will shape emerging market investment opportunities over the next decade, with a turning “TIDE” propelled by the following themes: Transformation of China’s private sector, India’s renaissance, Downstream impact of artificial intelligence and Energy transition. We also believe emerging market equities remain attractive because they are mispriced, with valuation discounts of nearly 30% and 40% relative to global and US equities, respectively.

Top issuers (% of total net assets)

|

Fund |

Index |

|

|

Taiwan Semiconductor Manufacturing Co Ltd (TSM) |

11.17 |

9.02 |

|

Tencent Holdings Ltd (OTCPK:TCEHY) |

5.62 |

4.54 |

|

H World Group Ltd (HTHT) |

5.12 |

0.09 |

|

Kotak Mahindra Bank Ltd |

4.79 |

0.29 |

|

Samsung Electronics Co Ltd (OTCPK:SSNLF) |

4.01 |

3.11 |

|

Fomento Economico Mexicano SAB de CV (FMX) |

3.14 |

0.22 |

|

Meituan (OTCPK:MPNGF) |

2.94 |

1.34 |

|

HDFC Bank Ltd (HDB) |

2.92 |

1.07 |

|

Alibaba Group Holding Ltd (BABA) |

2.68 |

2.61 |

|

Tata Consultancy Services Ltd |

2.47 |

0.56 |

|

As of 09/30/24. Holdings are subject to change and are not buy/sell recommendations. |

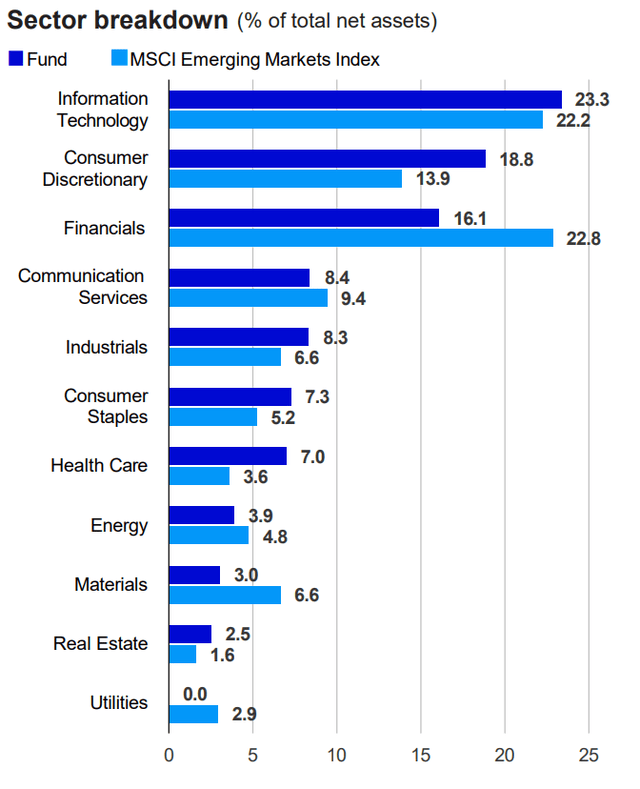

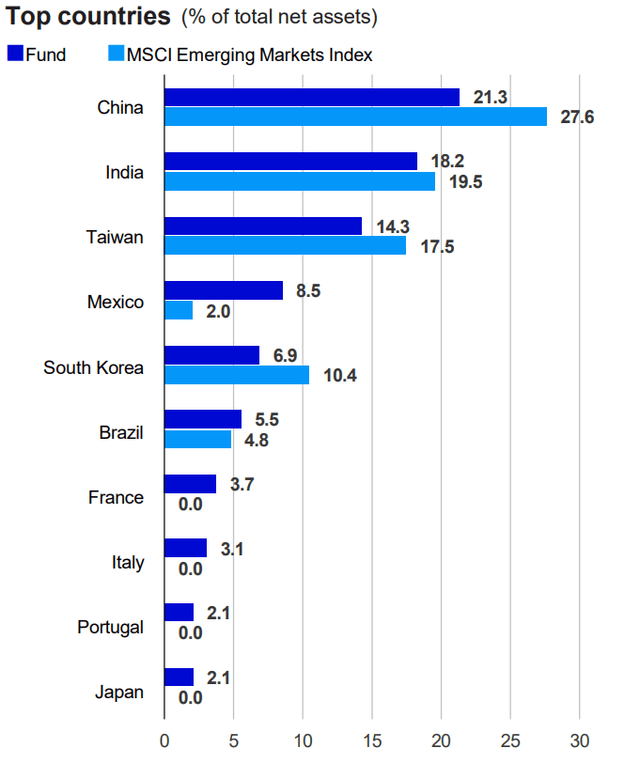

Portfolio positioning

We use a bottom-up, benchmark agnostic approach. Sector and country exposures are a by-product of stock selection. Sector and industry weights reflect areas where we tend to find extraordinary companies, identify dynamic changes and see real value creation. Those areas include technology, consumer, health care, financials and resources/industrials. As of quarter end, relative to the MSCI EM Index, the fund was overweight in consumer discretionary, health care, industrials, consumer staples, real estate and information technology, while underweight in financials, materials, utilities, communication services and energy.

During the quarter, we initiated positions in Chinese multinational Alibaba, Chinese e-commerce company Meituan, Italian luxury fashion brand Moncler, US-based Legend Biotech (LEGN) and Taiwan-based Han Hai. We sold positions in AMBEV (ABEV), L’Oreal (OTCPK:LRLCF), Bank Bakyat Indonesia, B3 SA and Novatek (OTC:NSTKF).

We added to the following existing positions:

AIA is a Hong Kong-based multinational insurance and finance corporation.

Fomento Economico Mexicano (FEMSA) is a leading Latin American convenience store chain and beverage company.

Argenx (ARGX) is a Netherlands-based global immunology biotech company that develops human antibody products for severe autoimmune diseases and cancer.

Bharti Airtel is an India-based multinational telecommunications services company, operating in 18 countries across South Asia and Africa, as well as the Channel Islands.

Raia Drogasil (OTCPK:RADLY) is Latin America’s largest drugstore company by revenue and market capitalization, headquartered in São Paulo with 3,000 pharmacies in Brazil.

We trimmed the following positions:

Tencent is a Chinese internet and technology company and long-term fund holding with a robust suite of digital offerings.

Taiwan Semiconductor Manufacturing Co. (TSMC) is one of the world’s leading semiconductor foundries and a key enabler of the new computing revolution, with multiple architectures, chip platforms and design teams competing to push computing and AI innovation. Grupo Mexico is a diversified mining company. When the stock performed well in the third quarter, we took the opportunity to trim the position.

Yum China operates a portfolio of quick serve restaurants in China’s underpenetrated market, with notable brands such as KFC and Pizza Hut.

HDFC Bank is India’s largest private sector bank. In 2023, HDFC Bank merged with its parent, HDFC Corp., a long-term fund holding.

Top contributors (%)

|

Issuer |

Return |

Contrib. to return |

|

Meituan |

42.83 |

0.91 |

|

Tencent Holdings Limited |

17.42 |

0.86 |

|

SAMSUNG BIOLOGICS Co., Ltd. |

40.93 |

0.61 |

|

H World Group Limited |

14.03 |

0.61 |

|

Alibaba Group Holding Limited |

26.50 |

0.50 |

Top detractors (%)

|

Issuer |

Return |

Contrib. to return |

|

Samsung Electronics Co., Ltd. |

-20.24 |

-1.18 |

|

Fomento Economico Mexicano, S.A.B. de C.V. |

-6.94 |

-0.28 |

|

PDD Holdings Inc. |

1.62 |

-0.26 |

|

Galp Energia, SGPS S.A. |

-10.12 |

-0.22 |

|

SK hynix Inc. |

-22.04 |

-0.19 |

Performance highlights

In our view, the real reason to invest in developing market equities is the opportunity to capture unique companies with durable long-term growth and sustainable advantages, including rare companies that have considerable real options often unappreciated by conventional wisdom. We typically avoid companies with governance conflicts, unsustainable advantages, mean reversion, product cycle/gadgets and capital intensive/cyclical industries.

From a sector perspective, stock selection in industrials added the most to relative return. An underweight in materials also added to relative results. The largest detractors from relative return were stock selection in consumer staples, consumer discretionary and financials.

Geographically, an overweight in Hong Kong and underweights in South Korea and Taiwan were the largest contributors to relative return. The largest detractors from relative return were stock selection and an underweight in China and overweights in Mexico and Portugal.

Absolute Contributors to performance

Meituan operates China’s leading service-based e-commerce platform. The shares rallied in September in response to China’s announced economic stimulus.

Tencent is a Chinese internet and technology company that has developed a robust suite of digital offerings. The company’s shares rallied in September on the possibility of China’s economic revival following positive stimulus policy.

Samsung Biologics is a South Korean biologics manufacturer. Concerning the proposed BIOSECURE Act that would restrict US federal funding and partnerships with certain Chinese companies, management has a relatively conservative stance on the near-term impact should the act become law. However, it could be more positive for commercial projects mid to long term.

Detractors from absolute return

Samsung Electronics is a South Korean company that produces semiconductors in conjunction with consumer electronic products, industrial equipment and internet access network systems. The stock declined in the third quarter, hampered by a broader sell-off that was apparently largely triggered by chipmaker NVIDIA’s lackluster second-quarter earnings.

Fomento Economico Mexicano (FEMSA) operates Latin America’s leading convenience store chain and beverage company. Mexican equities have been notably weak in recent months due to market volatility associated with its presidential election.

PDD is a Chinese e-commerce company that pioneered the successful group purchase model. The stock declined notably in August after company management shared a pessimistic outlook that its high revenue growth is not sustainable. However, the stock rallied in September following the Chinese government’s economic stimulus announcement.

|

Calendar year total returns (%) |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Class A shares at NAV |

-4.80 |

-14.06 |

6.89 |

34.77 |

-12.14 |

23.99 |

17.22 |

-7.50 |

-25.16 |

11.17 |

|

Class R6 shares at NAV |

-4.39 |

-13.67 |

7.38 |

35.33 |

-11.79 |

24.53 |

17.66 |

-7.13 |

-24.85 |

11.54 |

|

Class Y shares at NAV |

-4.55 |

-13.84 |

7.16 |

35.10 |

-11.95 |

24.31 |

17.51 |

-7.25 |

-24.97 |

11.40 |

|

MSCI Emerging Markets Index |

-2.19 |

-14.92 |

11.19 |

37.28 |

-14.57 |

18.42 |

18.31 |

-2.54 |

-20.09 |

9.83 |

Portfolio characteristics*

|

Fund |

Index |

|

|

No. of holdings |

84 |

1,277 |

|

Top 10 issuers (% of AUM) |

44.81 |

25.53 |

|

Wtd. avg. mkt. cap ($M) |

184,821 |

150,207 |

|

Price/earnings |

21.17 |

15.82 |

|

Price to book |

3.24 |

1.92 |

|

Est. 3 – 5 year EPS growth (%) |

17.50 |

16.12 |

|

ROE (%) |

18.56 |

15.96 |

|

Long-term debt to capital (%) |

25.37 |

21.42 |

|

Operating margin (%) |

22.41 |

19.95 |

Risk statistics (5 years)*

|

Fund |

Index |

|

|

Alpha (%) |

-3.80 |

0.00 |

|

Beta |

0.98 |

1.00 |

|

Sharpe ratio |

-0.04 |

0.18 |

|

Information ratio |

-0.66 |

0.00 |

|

Standard dev. (%) |

19.36 |

18.63 |

|

Tracking error (%) |

6.37 |

0.00 |

|

Up capture (%) |

81.89 |

100.00 |

|

Down capture (%) |

102.84 |

100.00 |

|

Max. drawdown (%) |

42.91 |

35.98 |

Quarterly performance attribution

Sector performance analysis (%)

|

Sector |

Allocation effect |

Selection effect |

Total effect |

|

Communication Services |

-0.11 |

-0.34 |

-0.45 |

|

Consumer Discretionary |

0.63 |

-1.67 |

-1.03 |

|

Consumer Staples |

0.11 |

-1.15 |

-1.04 |

|

Energy |

0.11 |

-0.29 |

-0.18 |

|

Financials |

-0.06 |

-0.40 |

-0.46 |

|

Health Care |

0.52 |

-0.79 |

-0.27 |

|

Industrials |

-0.02 |

0.22 |

0.20 |

|

Information Technology |

0.16 |

-0.27 |

-0.11 |

|

Materials |

0.11 |

0.06 |

0.16 |

|

Real Estate |

0.07 |

-0.35 |

-0.28 |

|

Utilities |

-0.01 |

0.00 |

-0.01 |

|

Cash |

-0.21 |

0.00 |

-0.21 |

|

Total |

1.29 |

-4.97 |

-3.68 |

|

Holdings are subject to change and are not buy/sell recommendations. Attribution methodology notes: The attribution provides analysis of the effects of several portfolio management decisions, including allocation and security selection. Securities classified as “Other” may include non-equity securities, derivatives, and securities for which a sector classification may not be appropriate. The portfolio is actively managed and portfolio holdings are subject to change. The percentage weights represented for the portfolio are dollar weighted based on market value. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio. Past performance does not guarantee future results. |

Region performance analysis (%)

|

Region |

Allocation effect |

Selection effect |

Total effect |

|

Developed |

-0.45 |

0.00 |

-0.45 |

|

Asia/Pacific Ex Japan |

0.35 |

0.00 |

0.35 |

|

Europe |

-0.80 |

0.00 |

-0.80 |

|

Japan |

-0.01 |

0.00 |

-0.01 |

|

Emerging |

0.00 |

-3.02 |

-3.02 |

|

Africa/Mideast |

-0.08 |

-0.03 |

-0.11 |

|

Asia/Pacific Ex Japan |

-0.10 |

-2.05 |

-2.15 |

|

Europe |

0.08 |

-0.19 |

-0.11 |

|

Latin America |

-0.39 |

-0.27 |

-0.66 |

|

Cash |

-0.21 |

0.00 |

-0.21 |

|

Total |

-0.66 |

-3.02 |

-3.68 |

Performance analysis by country – top 5 (%)

|

Total effect |

Avg. weight |

Total return |

|

|

Hong Kong |

0.35 |

1.80 |

28.15 |

|

South Korea |

0.34 |

7.38 |

-9.63 |

|

Taiwan |

0.25 |

13.66 |

0.41 |

|

Brazil |

0.13 |

6.40 |

8.13 |

|

Philippines |

0.10 |

1.69 |

20.58 |

Performance analysis by country – bottom 5 (%)

|

Total effect |

Avg. weight |

Total return |

|

|

China |

-2.03 |

17.49 |

15.79 |

|

Mexico |

-0.85 |

9.77 |

-2.98 |

|

Portugal |

-0.43 |

2.09 |

-10.79 |

|

India |

-0.34 |

18.11 |

5.02 |

|

Thailand |

-0.26 |

0.00 |

0.00 |

|

Unless otherwise specified, all information is as of 09/30/24. Unless stated otherwise, Index refers to MSCI Emerging Markets Index. The MSCI Emerging Markets Index (ND) is an unmanaged index considered representative of stocks of developing countries. The index is computed using the net return, which withholds applicable taxes for non-residents investors. An investment cannot be made directly in an index. |

|

About risk In general, stock and other equity securities values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions. Derivatives may be more volatile and less liquid than traditional investments and are subject to market, interest rate, credit, leverage, counterparty, and management risks. An investment in a derivative could lose more than the cash amount invested. Environmental, Social and Governance considerations may vary across investments and issuers, and not every ESG factor may be identified or evaluated for investment. The Fund will not be solely based on ESG considerations; therefore, issuers may not be considered ESG-focused companies. ESG factors may affect the Fund’s exposure to certain companies or industries and may not work as intended. The Fund may underperform other funds that do not assess ESG factors or that use a different methodology to identify and/or incorporate ESG factors. ESG is not a uniformly defined characteristic and as a result, information used by the Fund to evaluate such factors may not be readily available, complete or accurate, and may vary across providers and issuers. There is no guarantee that ESG considerations will enhance Fund performance. The risks of investing in securities of foreign issuers, including emerging markets, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues. The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments. Growth stocks tend to be more sensitive to changes in their earnings and can be more volatile. The Fund may hold illiquid securities that it may be unable to sell at the preferred time or price and could lose its entire investment in such securities. Following Russia’s invasion of Ukraine in February 2022, various countries, including the U.S., NATO and the European Union, issued broad-ranging economic sanctions against Russia and Belarus. As a result, responses to military actions (and further potential sanctions related to continued military activity), the potential for military escalation and other corresponding events, have had, and could continue to have, severe negative effects on regional and global economic and financial markets, including increased volatility, reduced liquidity, and overall uncertainty. Russia may take additional counter measures or retaliatory actions (including cyberattacks), which could exacerbate negative consequences on global financial markets. The duration of ongoing hostilities, corresponding sanctions and related events cannot be predicted. As a result, the value of an investment in the Fund and its performance may be negatively impacted, particularly as it relates to Russia exposure. Stocks of small and medium-sized companies tend to be more vulnerable to adverse developments, may be more volatile, and may be illiquid or restricted as to resale. The fund is subject to certain other risks. Please see the current prospectus for more information regarding the risks associated with an investment in the fund. The opinions expressed are those of the fund’s portfolio management, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. Investing in securities of Chinese companies involves additional risks, including, but not limited to: the economy of China differs, often unfavorably, from the U.S. economy in such respects as structure, general development, government involvement, wealth distribution, rate of inflation, growth rate, allocation of resources and capital reinvestment, among others; the central government has historically exercised substantial control over virtually every sector of the Chinese economy through administrative regulation and/or state ownership; and actions of the Chinese central and local government authorities continue to have a substantial effect on economic conditions in China. The investment techniques and risk analysis used by the portfolio managers may not produce the desired results. This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions. Note: Not all products available at all firms. Financial professionals, please contact your home office. The fund holdings are organized according to the Global Industry Classification Standard, which was developed by and is the exclusive property and service mark of MSCI Inc. and Standard & Poor’s. * Alpha (cash adjusted) is a measure of performance on a risk-adjusted basis. Beta (cash adjusted) is a measure of relative risk and the slope of regression. Sharpe Ratio is a risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. A higher Sharpe ratio indicates better risk-adjusted performance. Information Ratio is a measurement of portfolio returns beyond the returns of a benchmark, usually an index, compared to the volatility of those returns. Standard deviation measures a fund’s range of total returns and identifies the spread of a fund’s short-term fluctuations. Tracking Error is defined as the expected standard deviation of a portfolio’s excess return over the benchmark index return. The up and down capture measures how well a manager was able to replicate or improve on periods of positive benchmark returns and how severely the manager was affected by periods of negative benchmark returns. Maximum Drawdown is the maximum observed loss from a high to a low of a portfolio, before a new high is attained. Maximum drawdown is an indicator of downside risk over a specified time period. Weighted Average Market Cap is a measure of the average size of company held in a portfolio. The percentage of the portfolio invested each company, or its weight, is multiplied by its size (market capitalization). An average of the weighted size of all companies held is then calculated. Price/earnings measures the price per share relative to the earnings per share of the company while excluding extraordinary items. Price to book measures the firm’s capitalization (market price) to book value. Est. 3-5 year EPS (Earning per share) growth measures the earning per share growth from FY3 to FY5. ROE is the Return on Equity that measures the fund’s annual return relative to total shareholders’ equity. This ratio evaluates how quickly investments can be turned into profits. Long-term debt to capital measures a fund’s financial leverage by calculating the proportion of long-term debt used to finance its assets relative to the amount of equity used for the same purpose. A higher ratio indicates higher leverage. Operating margin measures the profit a fund makes for every dollar of sales after paying the variable expenses. Contribution to Return measures the performance impact from portfolio holdings over a defined time period. It takes into account both weight and performance of the portfolio holdings. Contribution to Return is calculated at security level. Morningstar Source: ©2024 Morningstar Inc. All rights reserved. The information contained herein is proprietary to Morningstar and/or its content providers. It may not be copied or distributed and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Open-end mutual funds and exchange-traded funds are considered a single population for comparison purposes. Had fees not been waived and/or expenses reimbursed currently or in the past, the ranking would have been lower. Rankings for other share classes may differ due to different performance characteristics. Before investing, consider the Fund’s investment objectives, risks, charges and expenses. Visit invesco.com/fundprospectus for a prospectus/summary prospectus containing this information. Read it carefully before investing. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.