If you want to make investing easy on yourself, one of the best ways to do it is by buying an ETF that tracks the S&P 500. By purchasing shares of an exchange-traded fund like the Vanguard 500 Index ETF or the SPDR S&P 500 ETF, you can gain instant access to a diversified group of 500 of the biggest U.S. companies.

It’s not easy to beat the S&P 500. In fact, most hedge funds and mutual funds underperform the S&P 500 over an extended period of time. That’s because the S&P 500 selects from a large pool of stocks and continuously refreshes its holdings, dumping underperformers and replacing them with up-and-coming growth stocks.

For example, the index just swapped aging appliance maker Whirlpool for the explosive AI server company Super Micro Computer. Owning only profitable, large-cap U.S. stocks is another reason why the S&P 500 tends to be such a strong performer over time.

However, some funds do manage to beat the broad-market index. Keep reading to see one ETF that has a long-term track record of outperforming the S&P 500.

Growth at a reasonable price

Most stocks are typically grouped into one of two buckets: growth or value. Growth stocks generally have higher growth rates than the broad market, while value stocks trade at a discount to the S&P 500, typically measured by the price-to-earnings ratio.

However, there’s also a hybrid group of stocks that have elements of both growth and value known as “growth at a reasonable price,” or GARP. And there’s one ETF that specializes in those stocks.

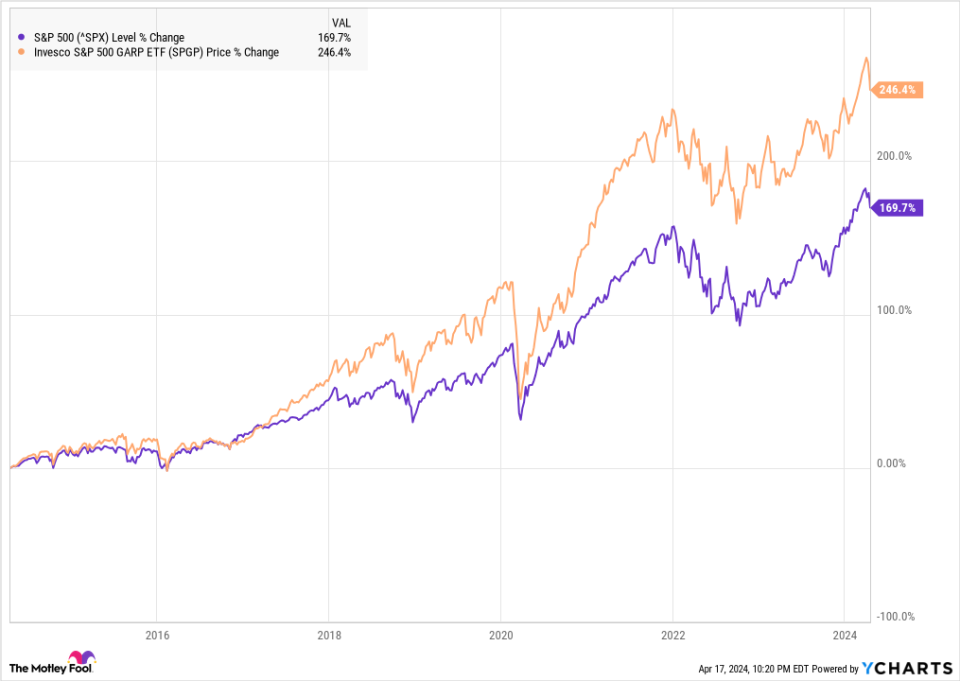

That’s the Invesco S&P 500 GARP ETF (NYSEMKT: SPGP), which has beaten the S&P 500 in seven of the last 10 years and has steadily outperformed it over the last decade, as you can see from the chart below.

As you can see, not only has the Invesco GARP ETF beaten the S&P 500, but it’s moved along the same trajectory as the S&P 500, meaning it’s been able to outgain without much additional risk.

What is the Invesco GARP ETF?

The Invesco S&P 500 GARP ETF tracks the S&P 500 Growth at a Reasonable Price Index, which is made up of about 75 stocks that have been ranked as having the highest “growth scores,” which is based on earnings and sales-per-share growth over the last three years, and “quality and value composite score,” which is based on financial leverage, return on equity, and price-to-earnings ratio.

The fund’s five-biggest holdings are Diamondback Energy, an exploration and production energy company in the Permian Basin; Steel Dynamics, one of the largest steel producers and metal recyclers in the country; Marathon Petroleum, an oil refiner and transportation company; CF Industries, a maker of nitrogen fertilizer and other agricultural products; and Nucor, the steel manufacturer that popularized mini-mills.

Four of the next five top holdings are energy stocks as well. In fact, the index’s biggest sector currently is energy, which makes up 26.1% of the fund, followed by information technology at 22%.

Why the GARP ETF could continue to outperform

The standards of the GARP ETF screen out both overvalued stocks and those that aren’t growing fast enough, making the ETF a good bet to beat the larger index.

Much of the Magnificent Seven stocks that have driven the new bull market look stretched, and the S&P 500’s valuation is high, especially at an early stage of a new bull market, according to a number of conventional metrics. For example, the S&P 500 trades at a price-to-earnings ratio of 25.2, compared to a P/E of just 15.3.

Barring a crash in oil prices, which would hammer the energy stocks that make up a significant portion of the GARP ETF, the fund looks well-positioned to beat the S&P 500 as the early gains from the Magnificent Seven stocks should spread to the rest of the stock market as the bull market matures. Meanwhile, its valuation should also cushion it from any sell-off in the broad market.

Should you invest $1,000 in Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Garp ETF right now?

Before you buy stock in Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Garp ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Garp ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

How Do You Beat the S&P 500? Buy This ETF That Has Done It in 7 of the Last 10 Years was originally published by The Motley Fool