THE HOTTEST COMMODITY M&A MARKET ON THE PLANET

Over $5.6 Billion in strategic funding and M&A have been announced in the first 120 days of 2024 in the lithium industry as lithium prices begin to rally once again.

Lithium has received more strategic funding and M&A than any other commodity we are aware of.

Lithium prices are up 250% from pandemic lows with strategic funding and M&A still soaring despite prices being down from 2022 highs. The commodity is now on its way up again – Already up ~ 20% this year. The smart money is acquiring lithium now, underlined by a number of recently announced M&A transactions.

Lithium industry pioneer and Scorpion Minerals boss Michael Fotios believes a potential tripling in carbonate prices could be in the cards by the end of the year.

…” As lepidolite mining in China stalls and growth in electric vehicle production surges, Fotios – a second-generation geologist and founding father of Galaxy Resources – says carbonate prices could lift from their current base of US$18,000/t up to projections of US$50,000/t.

NO LITHIUM = NO EVS = NO CELL PHONES OR TABLETS

Take it from the smartest investor in history, Warren Buffett.

“Be greedy when others are fearful. Be fearful when others are greedy.” And the big players are cashing in on lithium in Argentina, located in the prolific Lithium triangle.

In Fact, Mr. Buffett’s Berkshire Hathaway is investing in the lithium according to a recent article by Seeking Alpha.

Argentina’s lithium sector is surging, with a series of high-profile transactions in late 2024 and early 2025 underscoring the country’s growing importance in the global energy transition.

Zijin Mining Group completed the $960 million acquisition of Neo Lithium’s Tres Quebradas project, further solidifying its position in the high-grade lithium brine space. Meanwhile, TechEnergy, a subsidiary of Tecpetrol, acquired a 30% stake in a Salta-based salar project for $250 million, signaling increased interest from regional players in lithium development.

Perhaps the most notable transaction came as Rio Tinto acquired Arcadium Lithium in a landmark $6.7 billion deal. This acquisition not only strengthens Rio Tinto’s foothold in the South American lithium market but also reflects the broader trend of major mining firms moving aggressively to secure critical mineral resources.

Lithium Batteries Are the New Oil,’ According to Elon Musk

Elon Musk went on record describing lithium as “the new oil,” pointing out that the light metallic element now forms a vital link in the automotive industry and supply chain. Lithium is an essential component of modern rechargeable battery technology and is found in everything from smartphones and tablets to laptop computers to electric-powered bicycles and automobiles.

We are going to explain how you could get involved in capitalizing in the hottest M&A Sector and the future of the green transition – Lithium in Argentina.

There is a company we want to introduce to you that we believe, if successful, can be part of the solution for lithium independence across the Americas.

Its name is American Salars Lithium Inc. (OTC: USLIF | CSE: USLI).

Before you read another word, however, add this stock to the list of companies you watch RIGHT NOW.

Why?

Because it aims to become a premier miner of lithium in Argentina, currently in the hottest commodity M&A market on Earth right now.

American Salars Lithium Inc. is quietly shaping up to be one of the most exciting under-the-radar lithium stories on the market. With a market cap under $10 million, this junior explorer is flying way below the radar—but not for long.

The spotlight is on its flagship Pocitos Lithium Brine Project, covering a massive 13,880 hectares in Salta Province. This includes 800 hectares at Pocitos 1, where a 2023 NI 43-101 resource estimate clocked in at 760,000 tonnes of inferred lithium carbonate equivalent (LCE)—and that’s just from one zone.

What’s even more impressive? Brine samples from a key drill hole (PCT22-03) showed 169 ppm lithium with continuous flow for five hours—solid signs of strong brine movement. Then came the kicker: Ekosolve’s DLE tech pulled 94% lithium recovery and 99.8% purity, proving this project can deliver clean, scalable lithium using modern tech.

In a region heating up with M&A activity, American Salars has the land, the grades, and the chemistry to attract serious attention. It’s a classic lithium sleeper story—small now, but with big upside potential.

What Nobody Is Telling You about Lithium Right Now

Lithium Mergers, Acquisitions and Strategic Funding is at an all time high in 2024. Lower lithium prices mean more industry consolidation and more opportunity to profit.

Lithium projects like the ones American Salars (OTC:USLIF / CSE:USLI) is developing with a staggering inferred 457,000 tonne lithium resource already in place are being bought up by larger players that are recognizing these low costs resources hold the key to economic lithium mining for the future of the battery market.

The lithium M&A trend seams to be unstoppable.

A list of some recent transaction:

Why is Lithium so important?

Most investors don’t get this…

So, you will be ahead of the curve if you do.

Let us explain in detail why according to Elon Musk Lithium could be as important in the 21st century as oil and gas was to the 20th.

In just two centuries since its discovery, lithium has become one of humanity’s most versatile commodities. Early in the Boom, lithium proved to be an effective mood stabilizer, and it would still be a valuable material if that were the only use, we ever found for it.

But that’s hardly the case. It wasn’t long before industrial uses emerged, and lithium became a major additive to lubricants, as well as an input to smelting, manufacturing and catalytic processes.

Lithium’s importance didn’t stop there. In its metallic form lithium efficiently conducts heat and electricity, making it an ideal medium for storing and transmitting energy. Its high charge and power-to-weight ratio make it an ideal material for rechargeable batteries.

And that’s what’s commanding the investment community’s attention as the world moves to electric cars and transport.

Rechargeable batteries using lithium emerged in response to the 1970s’ oil shocks. After years of development, the high-powered lithium-ion battery entered the market. From consumer electronics to military equipment to aerospace, the Lithium-Ion Battery revolutionized dozens of applications.

Then came smart phones and tablets. Then came electric vehicles.

EVs alone could drive a 5x lithium demand increase by 2040. As a result, the global Lithium Battery market is estimated to reach a value of US$75 billion by 2027.

We might only be in the early stages of lithium’s contributions to solving the world’s energy storage challenges. The more we come to adopt renewable energy sources, the more reliant we’ll be on the sun always shining on the solar array or the wind always spinning the turbines. Since neither of these things is ever going to happen, we remain in critical need for some way of keeping the power we generate available until the moment it’s needed to light up a screen or power a car.

This expanding demand won’t likely be confined to the developed world.

“Lithium’s role in the decarbonization of the global economy is so important that several countries have classified it as a critical or strategic raw material,” — ILA.

Growing demand tends to lead higher prices, and such is the case with lithium.

Over the past seven years, lithium carbonate spot prices have skyrocketed—rising tenfold as demand for the critical battery metal surged. While the long-term trend has been bullish, 2022 marked a breakout moment. Prices exploded from just $12,600 to a staggering $68,100 USD per metric ton, catching even seasoned market watchers off guard.

By late 2023, the market cooled, with spot prices pulling back into the $12,000–$18,000 USD range. But rather than signaling a slowdown, many analysts saw the retrenchment as a rare window for strategic investment—both in lithium itself and in the companies producing it.

That thesis quickly proved right. In the first five months of 2024 alone, lithium-related transactions surged past $5 billion, highlighting renewed confidence in the sector.

Then came 2025’s headline-grabbing moment: Rio Tinto’s $6.7 billion acquisition of Arcadium Lithium—a blockbuster deal that eclipsed all of 2024’s M&A activity in a single move. The transaction sent a clear message to the market: the lithium race is far from over, and the stakes are only getting higher.

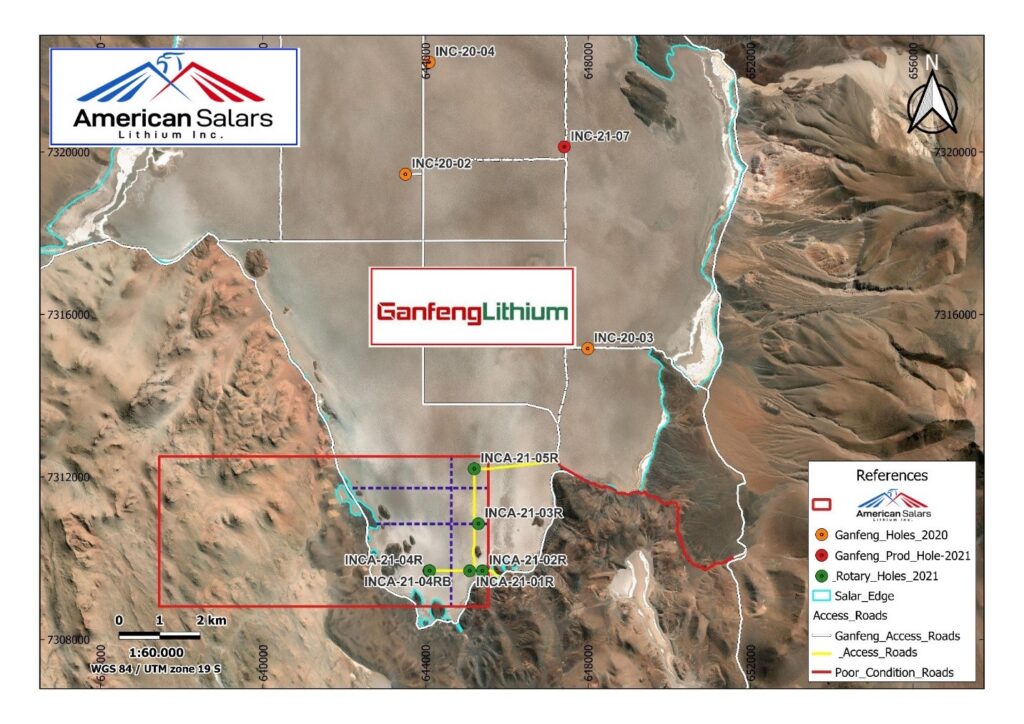

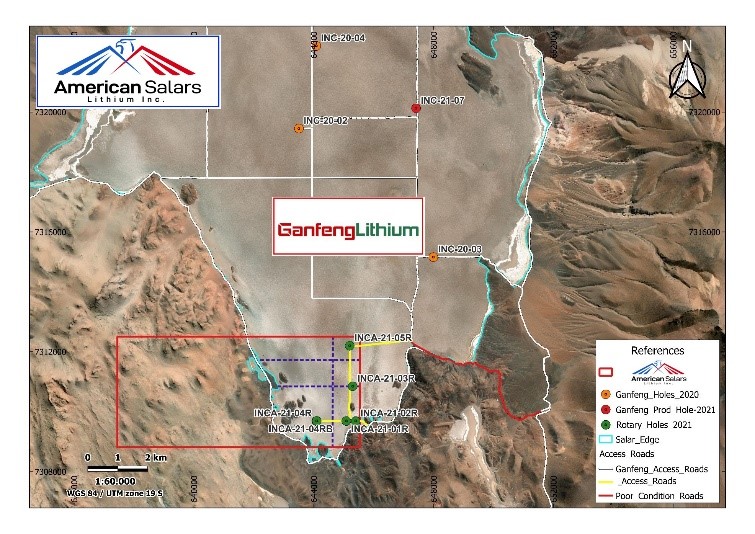

American Salars (OTC:USLIF / CSE:USLI) is in the right neighbourhood (Argentina) with an established and growing resource, with a sub $10 Million market cap, next door to the Conglomerate Gangfeng with a $10 Billion Market Cap.

Stock Information

American Salars Lithium Inc.

OTC: USLIF CSE: USLI

Stay up to date and subscribe to our free investor service.

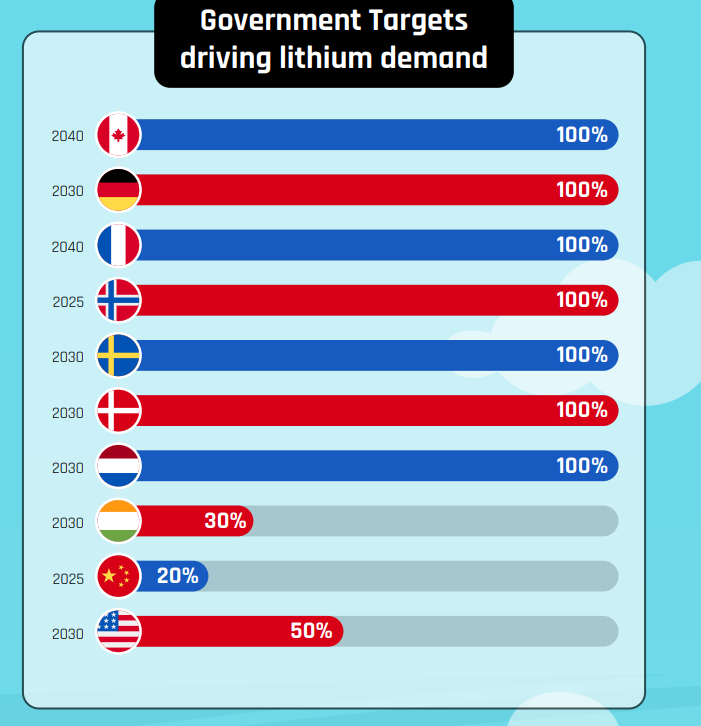

World Governments Creating New Policy for Lithium

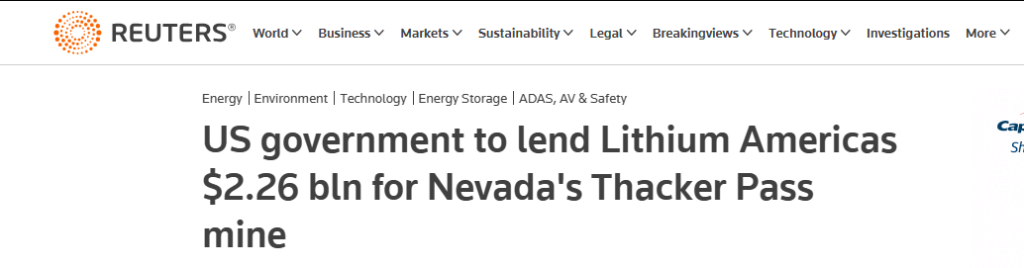

The Inflation Reduction Act has committed 100s of Billions to new climate and energy investment of which lithium is deemed a critical mineral. – In fact,… The US Government is now funding lithium mines with the announcement of $2.26 Billion for Thacker Pass

And nearly every developed nation on the planet now has an objective for the majority of their cars on the road to be electric by 2030.

Why you should invest in American Salars

The Technology

Let’s remember this is only an initial resource estimate. A targeted drill program could significantly increase this number. There’s plenty of room to grow—so long as the company avoids the “pile it high, sell it cheap” mindset.

American Salars (OTC: USLIF / CSE: USLI) takes pride in its innovative approach, bringing human value to natural resources.

Brine projects like American Salars’ offer two key benefits: a smaller environmental footprint and lower resource development costs.

Direct lithium extraction (DLE) mines represent a modern solution—extracting brine, filtering lithium and valuable minerals, and returning or reusing freshwater.

In contrast, evaporative brine mining—still used by many competitors—wastes large volumes of water, causes environmental harm, and sparks political controversy, according to Argentinian academics.

DLE is an ESG-friendly technology that, when applied correctly, can even provide potable water in arid regions. This isn’t the dirty, exploitative mining of the past.

The Portfolio

1. Pocitos Lithium Brine Project (Salta Province, Argentina)

American Salars’ flagship project, the Pocitos Lithium Brine Project, consists of 800 hectares at Pocitos 1 and an additional 13,080 hectares under a binding LOI, bringing the total land position to 13,880 hectares in the heart of the Lithium Triangle. A 2023 NI 43-101 inferred resource estimate completed by WSP Australia reported 760,000 tonnes of lithium carbonate equivalent (LCE), all derived from drilling on Pocitos 1. Brine samples from drill hole PCT22-03 showed 169 ppm lithium with sustained flow over 5 hours, indicating excellent brine movement. DLE tests conducted by Ekosolve Ltd. achieved a 94% lithium recovery rate and 99.8% purity, validating the project’s economic potential.

2. Black Rock South Lithium Project (Nevada, USA)

Located in Nevada near Surge Battery Metals’ high-grade discovery, this early-stage exploration project offers American Salars exposure to the U.S. lithium supply chain in a mining-friendly jurisdiction.

3. Jaguaribe Lithium Project (Brazil)

Covering approximately 900 hectares, this lithium pegmatite project is located in Ceará State, Brazil. The area hosts numerous pegmatite bodies and has potential for lithium-bearing minerals like spodumene and lepidolite, supported by prior artisanal workings and regional sampling.

4. Quebec Lithium Project (James Bay, Quebec)

The Quebec Lithium Project comprises 31 mineral claims covering ~1,600 hectares in the prolific James Bay lithium district. Located near major discoveries such as Allkem’s James Bay Lithium and Patriot Battery Metals’ Corvette Project, this asset positions American Salars in one of Canada’s most active lithium exploration regions.

The Argentina advantage

In the early years of the lithium boom, Chile stood out as the Western Hemisphere’s top producer of lithium carbonate. Its vast reserves and investor-friendly legal framework made it a magnet for global capital. But fast forward to 2025, and that narrative has shifted dramatically. Political instability and aggressive state intervention have cast a long shadow over Chile’s mining sector, cooling investor appetite and stalling new development.

Today, Bolivia is believed to hold larger reserves than Chile, though much remains unverified. What’s increasingly clear is that the entire Lithium Triangle continues to reveal untapped potential. Argentina, forming the third side of that triangle, has emerged as the region’s top producer—outputting five times more lithium than Bolivia and quickly gaining global attention.

According to J.P. Morgan, Argentina is on track to become the world’s third-largest lithium supplier by 2030, trailing only Australia and China. It’s also where American Salars (OTC: USLIF | CSE: USLI) is focusing its exploration efforts.

Chile’s investment climate began to decline in 2022 with the rise of President Gabriel Boric’s Social Convergence party. The administration’s push for nationalization and constitutional reform shook investor confidence. As Americas Quarterly reported, no new lithium investments have been announced since April 2023, and existing contracts remain uncertain.

In contrast, Argentina offers a far more stable and attractive environment. Lithium rights are held at the provincial level, shielding them from national intervention, and royalty rates are significantly lower than in Chile or Bolivia. Since libertarian Javier Milei took office in 2023, pro-mining reforms have further encouraged foreign investment.

American Salars’ Pocitos 1 project is situated in Salta Province, within the heart of Argentina’s Lithium Triangle. The 800-hectare property hosts an NI 43-101 inferred resource of 760,000 tonnes of LCE, with strong brine flow rates and proven extraction efficiency.With a supportive regulatory environment and demonstrated resource potential, Pocitos 1 is positioned to become a key asset in one of the world’s most promising lithium regions.

AAA Team with the Track Record That Counts

Management and their Technical Team have been involved in many lithium projects across the Globe but most notably all of the biggest success’s have come in Argentina:

Mr. Philip Thomas the company’s QP (Qualified Person) independent technical person working on its lithium resource in Argentina was involved in the Rincon project, most recently sold to Rio Tinto for $825.0 Million. He was also involved in the Pozuelos Salar project sold to Gangfeng for $962 Million.

And again, guess who the neighbour is on this established Resource: Gangfeng

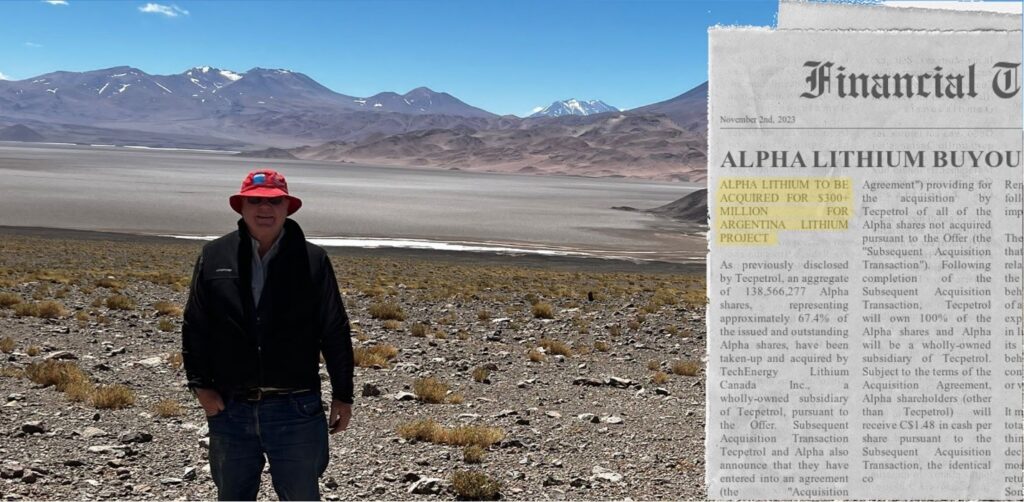

The company’s newest addition Mr. Chris Cooper less then a year ago was involved in the sale of Alpha’s Argentina Lithium Project for $313 Million.

American Salars (OTC: USLIF / CSE: USLI) a sub $10 Million company, with a $6.8 Billion in Ground inferred lithium resource with a team that knows how to get Argentina Lithium Projects developed and sold for hundreds of Millions of USD

At the close

Here’s why you should IMMEDIATELY put American Salars Lithium (OTC: USLIF / CSE:USLI) on your radar:

01

- Tech billionaires and the U.S. and Canadian governments are racing to boost lithium production to secure the future of battery metals.

02

- Management has been instrumental in three Argentina lithium brine projects that were sold for $313 million, $825 million, and $962 million.

03

Established Inferred Lithium Resource of 457,000 tonnes prepared by one of the largest lithium engineering funds on the Planet: WSP. And with its newly announced Pocitos 1 projects that number could be increased by another 456,000 tonnes in the near term,

04

IFN MENTAL MATH: At current spot price of approximately $10,000 USD per tonne, could have a staggering in ground value of *$9.13 Billion USD and the project is still expandable.

05

Mergers, acquisitions, and strategic funding in the lithium sector are at an all-time high—and this team has a proven track record of getting deals done.

06

American Salars (OTC: USLIF / CSE: USLI) is positioning itself as a key player in this vital industry.

07

Projects are strategically positioned near key shipping infrastructure at Chile’s Antofagasta Port.

08

- As a result, we URGE you to add American Salars Lithium (OTC: USLIF / CSE:USLI) to your watchlist and visit their website at www.americansalars.com

Quick Links to Preferred Brokerages

Stay up to date and subscribe to our free investor service.

Disclaimers

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

GENERAL NOTICE AND DISCLAIMER – PLEASE READ CAREFULLY THE FOLLOWING NOTICE AND DISCLAIMER MUST BE READ AND UNDERSTOOD AND YOU MUST AGREE TO THE TERMS CONTAINED THEREIN BEFORE USING THIS WEBSITE OR SUBSCRIBING TO OUR NEWSLETTER. We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of www.insidefinancialnews.com nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisors, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on insidefinancialnews.com. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Www.insidefinancialnews.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Www.insidefinancialnews.com has been retained by an unrelated third party to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from such third party. Questions regarding this website may be sent to INFO@INSIDEFINANCIALNEWS.COM. Some of the content on this website contains forward-looking information within the meaning of Section 27A of the Securities Act of 1993 and Section 21E of the Securities Exchange Act of 1934 including statements regarding expected continual growth of a company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website, or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources. www.insidefinancialnews.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and www.insidefinancialnews.com has no obligation to update any of the information provided. Insidefinancialnews.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time-to-time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the microcap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. www.insidefinancialnews.com encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Insidefinancialnews.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does www.insidefinancialnews.com control, endorse, or guarantee any content found in such sites. www.insidefinancialnews.com does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that insidefinancialnews.com, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third-party website. You further agree that insidefinancialnews.com, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third-party content. Links and access to these sites are provided for your convenience only. www.insidefinancialnews.com uses third parties to disseminate information to subscribers. www.insidefinancialnews.com also places cookies on your computer to allow third party ads to retarget your IP address. By entering your phone number, you agree to allow www.insidefinancialnews.com to send SMS messages to your phone number. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrongdoing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer: Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information, you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions.

The Inside Financial News mobile message service (the “Service”) is operated by Financial Star News Inc. (“we”, or “us”). Your use of the Service constitutes your agreement to these terms and conditions (“Mobile Terms”). We may modify or cancel the Service or any of its features without notice. We may also modify these Mobile Terms at any time and your continued use of the Service following the effective date of any such changes shall constitute your acceptance of such changes.

We do not charge for the Service, but you are responsible for all charges and fees associated with text messaging imposed by your wireless provider. Message and data rates may apply.

Text messages may be sent using an automatic telephone dialing system or other technology. Your consent to receive autodialed marketing text messages is not required as a condition of purchasing any goods or services. If you have opted in, the Service provides updates, alerts, information, promotions, specials, and other marketing offers (e.g., newsletter subscription) from Financial Star News Inc. via text messages through your wireless provider to the mobile number you provided. Message frequency varies. Text the single keyword command STOP to cancel at any time. You’ll receive a one-time opt-out confirmation text message. If you have subscribed to other mobile message programs and wish to cancel, you will need to opt out separately from those programs by following the instructions provided in their respective mobile terms. For Service support or assistance, text HELP to or email info@insidefinancialnews.com.

We may change any short code or telephone number we use to operate the Service at any time and will notify you of these changes. You acknowledge that any messages, including any STOP or HELP requests, you send to a short code or telephone number we have changed may not be received and we will not be responsible for honoring requests made in such messages.

The wireless carriers supported by the Service are not liable for delayed or undelivered messages. You agree to provide us with a valid mobile number. You agree to maintain accurate, complete, and up-to-date information with us related to your receipt of messages, including, without limitation, notifying us immediately if you change your mobile number.

You agree to indemnify, defend, and hold us harmless from any third-party claims, liability, damages or costs arising from your use of the Service or from you providing us with a phone number that is not your own.

You agree that we will not be liable for failed, delayed, or misdirected delivery of any information sent through the Service, any errors in such information, and/or any action you may or may not take in reliance on the information or Service.

Forward-looking statements

This website contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 (collectively, “forward-looking statements”). These forward-looking statements are made as of the date of this document and the company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation. This corporate presentation may also include statements about historical resource calculations which has been taken from previous out-dated 43-101 technical reports.

Certain statements contained in this website may constitute forward-looking statements. These statements relate to future events or the future performance of the company. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “propose”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The company believes that the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included on this website should not be unduly relied upon by investors as actual results may vary. The company will not necessarily update this information unless it is required to by securities laws and the forward-looking statements contained in this website are expressly qualified in their entirety by this cautionary statement. This website also discloses mineral resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability. In particular, this website contains forward-looking statements, pertaining to the following:

- Capital expenditure programs; development of deposits and resources; treatment under regulatory regimes; expectations regarding the company’s ability to raise capital; work plans to be conducted by the company, and the production of gold and copper from the company’s mineral projects.

With respect to forward-looking statements listed above and contained in this presentation, the company has made assumptions regarding, among other things:

- The legislative and regulatory environment; the impact of increasing competition; current technological trends; unpredictable changes to the market prices for gold and copper; anticipated results of exploration and development activities; and that costs related to development of the gold and copper properties and the development of gold and copper production projects will remain consistent with historical experiences; and

- The company’s ability to obtain additional financing on satisfactory terms.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below:

- Uncertainties regarding the regulatory regime and the application approval process; volatility in the market prices for gold and copper; uncertainties associated with estimating and developing resources; geological, technical, construction and processing problems; liabilities and risks, including environmental liabilities and risks, inherent in developing BATTERY METAL projects; fluctuations in currency and interest rates; competition for, among other things, capital, acquisitions of mineral projects, undeveloped lands and skilled personnel; and unpredictable weather conditions.

Third-party names and trademarks

All product and company names are trademarks or registered trademarks of the respective third-party holders. Our use of such trademarks in our presentation does not imply any endorsement by or affiliation with such third parties.

AMERICAN SALARS LITHIUM INC.

*This is a Paid Promotion by AMERICAN SALARS LITHIUM INC.

Site Navigation

We bring you the best website that perfect for news, magazine, personal blog, etc. Check our landing page for details.

© 2025 Inside Financial News