Uranium Exploration Booms: 4 Stocks to Watch as Demand for Nuclear Fuel Soars

Not Financial Advice. Do your Due Diligence. We are a shareholder and therefore biased. We like the stock.

Warren Buffett, CEO of Berkshire Hathaway:

"Nuclear energy is a critical part of the world's energy future. It's reliable, scalable, and produces zero emissions. The uranium market will play a key role in this transition."

Uranium is regaining momentum as nuclear power becomes essential in the global clean energy transition. With rising demand, governments and private sectors are investing billions to expand uranium production and infrastructure, positioning the industry for long-term growth.

In Canada and the U.S., significant investments are boosting uranium mining and exploration. Canada is supporting projects in the Central Mining Belt, one of the world's richest uranium regions. Meanwhile, the U.S. Department of Energy is modernizing nuclear infrastructure and securing domestic uranium supplies to reduce reliance on foreign sources. These efforts are expected to strengthen the uranium market and create new opportunities for exploration and production companies.

The automotive sector is also contributing to uranium's resurgence. While EVs and hydrogen vehicles gain attention, the electricity needed to power them often comes from nuclear energy. Additionally, the rapid expansion of data centers and AI-driven technologies is increasing global power demand, further emphasizing nuclear energy's role as a reliable, low-carbon solution fueled by uranium.

Mike Alkin, Chief Investment Officer of Sachem Cove Partners:

"The uranium market is set for a multi-year bull run. The supply deficit is structural, and the demand story is only getting stronger with the push for clean energy."

Dark Star Minerals: Well-Positioned in the Uranium Sector

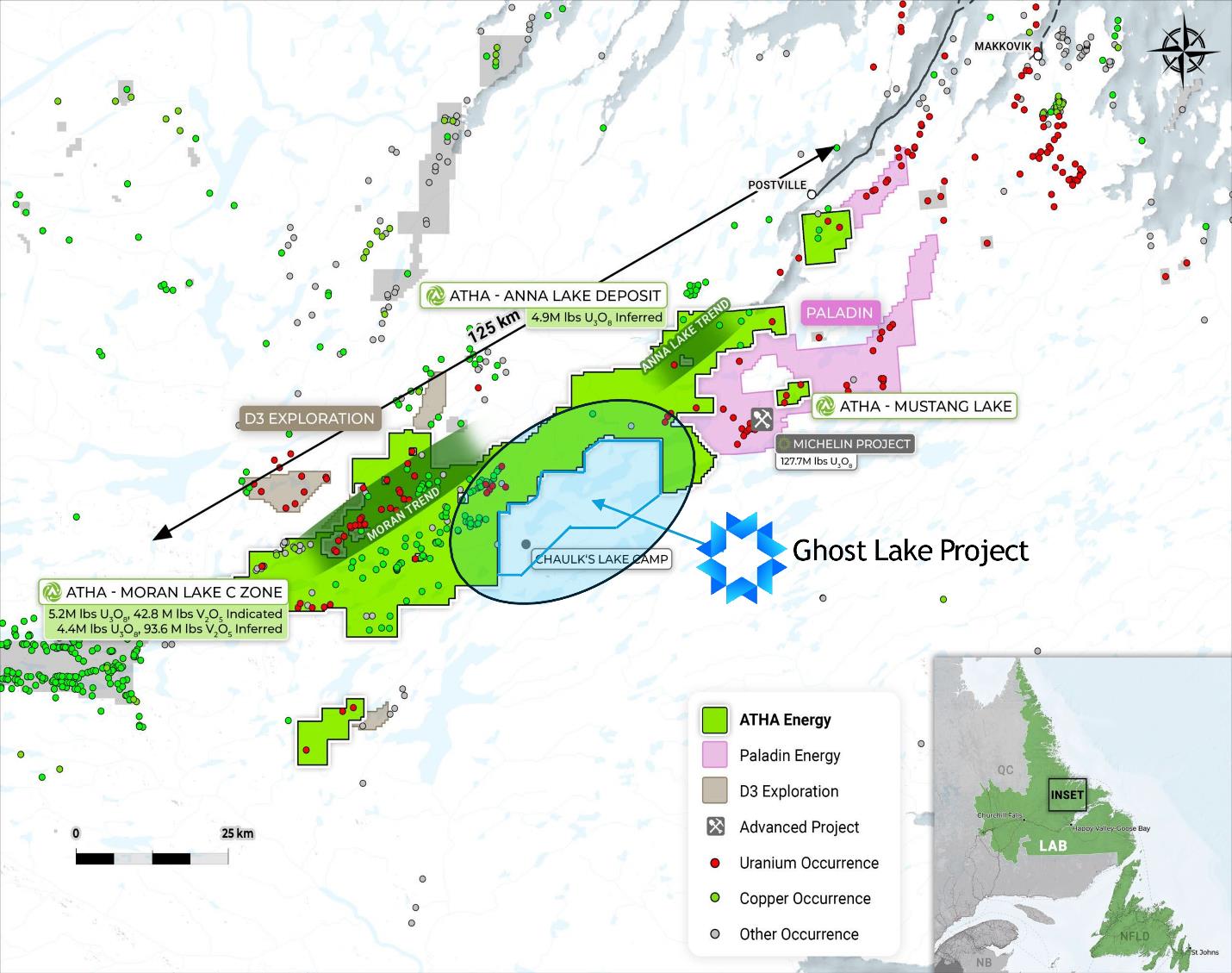

Dark Star Minerals (CSE: BATT) (FSE: P0W) is in the process of closing on 28,575 hectares of mineral claims in Newfoundland and Labrador, Canada, strategically located next to Paladin Energy's (ASX: PDN) (OTCQX: PALAF) Michelin Project, Atha Energy Corp's (TSX.V: SASK) (FRA: X5U) (OTCQB: SASKF) Anna Lake and Moran Lake deposits and Auric Minerals Corp.'s (CSE: AUMC) Bub Property. These claims include key uranium deposits such as Anna Lake, Moran Lake, and Mustang, positioning the company in a highly prospective uranium district.

The Michelin Project, Paladin Energy's flagship asset, is one of the region's largest uranium deposits, with a total Mineral Resource of 92 million pounds (Mlb) of uranium, including 82.2 Mlb in Measured and Indicated Resources. Nearby, the Anna Lake and Moran Lake projects add further potential with notable historical exploration results and untapped mineralization. Dark Star Minerals' claims are strategically positioned next to these major projects, sharing the same promising geological setting. (Paladin Energy)

This strategic positioning is particularly significant given the growing interest in Newfoundland and Labrador's Central Mineral Belt – one of the most uranium-rich regions globally. The area benefits from a supportive regulatory environment and strong local partnerships, including collaboration with the Nunatsiavut Government, which oversees the region on behalf of the Newfoundland and Labrador Inuit.

Dark Star Minerals (CSE: BATT) (FSE: P0W) made a key announcement in 2024: VANCOUVER, BRITISH COLUMBIA, June 03, 2024 – the Company entered into a letter of intent (LOI) to acquire all of the outstanding share capital of Ghost Lake Mining Corp (“Ghost Lake”). Ghost Lake holds an option to purchase a 100% interest in the Ghost Lake mining claims (the "Property").

Marc Branson, President, CEO, and director of Dark Star, stated: "We are very excited to expand our exploration prospects into Uranium. This purchase will give the Company the ability to be on the forefront of exploring for critical minerals and fulfilling our mission of creating Canada's energy independence through exploration.”

About the Property and Central Mineral Belt

Located in the prolific Central Mineral Belt (CMB) of Newfoundland and Labrador, the Ghost Lake Property consists of 28,575 hectares of contiguous claim blocks. The Property is bound on three sides (N, W, E) by properties held by Atha Energy Corp. (the “Atha Properties”) and overlaps structural trends with known deposits such as Paladin Energy Ltd.'s Michelin Project, Newfoundland and Labrador Uranium Inc.'s, and the Mustang Lake and Jacques Lake deposits. While the neighbouring Atha Properties host several uranium deposits, including Anna Lake, Moran Lake, and Mustang, mineralization on those properties is not necessarily indicative of potential on the Ghost Lake Property.

Targets on the Ghost Lake Property focus on areas of radiometric uranium highs over 0.5km² from regional airborne surveys. Primary targets include: Anomaly 24_1, an anomaly near historic uranium lake sediment samples, and Anomaly 24_3 (~15km²), located along the western margin of Ghost Lake covering historic “Anomaly B”. A northeast trending corridor—defined by anomalous uranium lake sediment samples along a trending fault—appears prospective for structurally related uranium mineralization.

See press release here: darkstarminerals.com

The uranium market is gaining significant momentum, and Dark Star Minerals is well positioned to capitalize on this growth. Their acquisition of Ghost Lake Mining Corp. marks a strategic step toward expanding their presence in Newfoundland and Labrador's Central Mineral Belt, one of the world's richest uranium regions.

Dark Star Minerals' proactive strategy signals exciting potential as they progress toward fulfilling their mission of supporting energy independence and sustainable resource development. The future looks bright for both the company and the uranium market.

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report is not tailored to individual circumstances. Free Market Media ("FreeMarket") was not paid a fee by Dark Star Minerals Inc. There may be third parties holding shares of Dark Star Minerals Inc. who could liquidate their positions, potentially affecting the stock price. This compensation constitutes a conflict of interest regarding our objectivity. Because of this, individuals are strongly encouraged not to use this publication as the sole basis for any investment decision. The owner/operator of Free Market Media owns shares of Dark Star Minerals Inc. FreeMarket reserves the right to buy and sell these shares at any time without further notice. While all information is believed to be reliable, it is not guaranteed to be accurate. Always perform your own independent research and consult a licensed investment professional before making any investment decision. Investing in securities carries a high degree of risk; you may lose some or all of your investment.