Major Strategic Investment by South32 and Teck – Cashes up American Eagle to over $37 Million in prolific Babine mining camp – Junior Mining Stocks that will benefit!

Gold is making headlines as it surges and makes new all-time highs, with investment banks like Goldman Sachs predicting prices could surpass $2,700 per ounce in early 2025 and the current trajectory suggesting it will happen much sooner. This rise is driven by Global economic uncertainty, inflation concerns, and geopolitical tensions, pushing investors towards the precious metal as a safe haven. Meanwhile, Copper surpassed $10,000 per tonne on China Stimulus measures currently over $8,000 per tonne, and The US Federal Reserve making its first 50 basis point rate cut last week. These two moves combined with Copper supply shortages looming should make for an exciting next period for Copper explorers and developers with many investment banks and famed investors believing the red metal is headed higher. As Copper and Gold prices climb, certain publicly traded companies in the mineral exploration and development sector stand to benefit significantly. Higher Copper and Gold prices boost profit margins for miners, increasing their value to investors and their ability to make major acquisitions of established Gold and/or Copper deposits around the Globe. With an underlying theme of Global tension, producers and developers are placing a much higher priority on acquiring and developing resources in domestic jurisdictions.

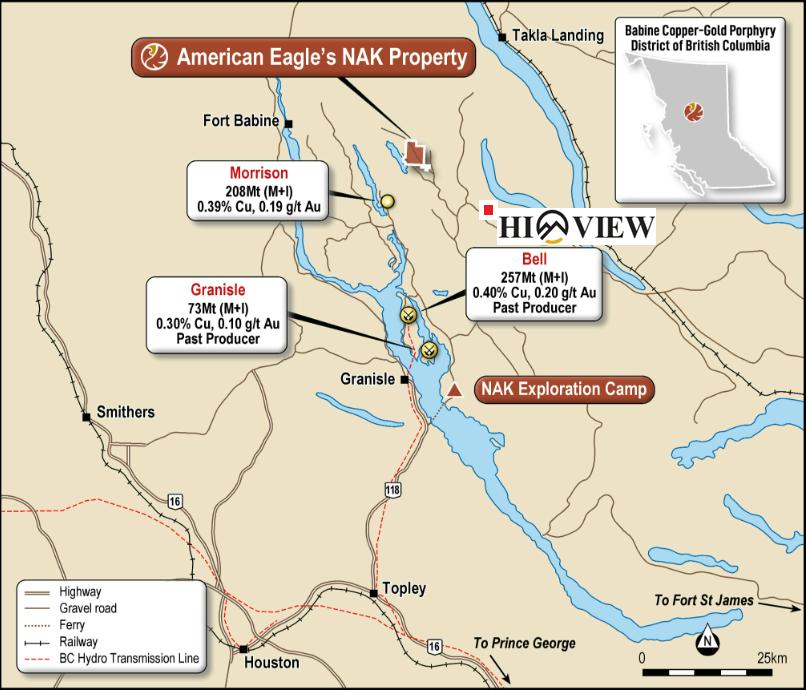

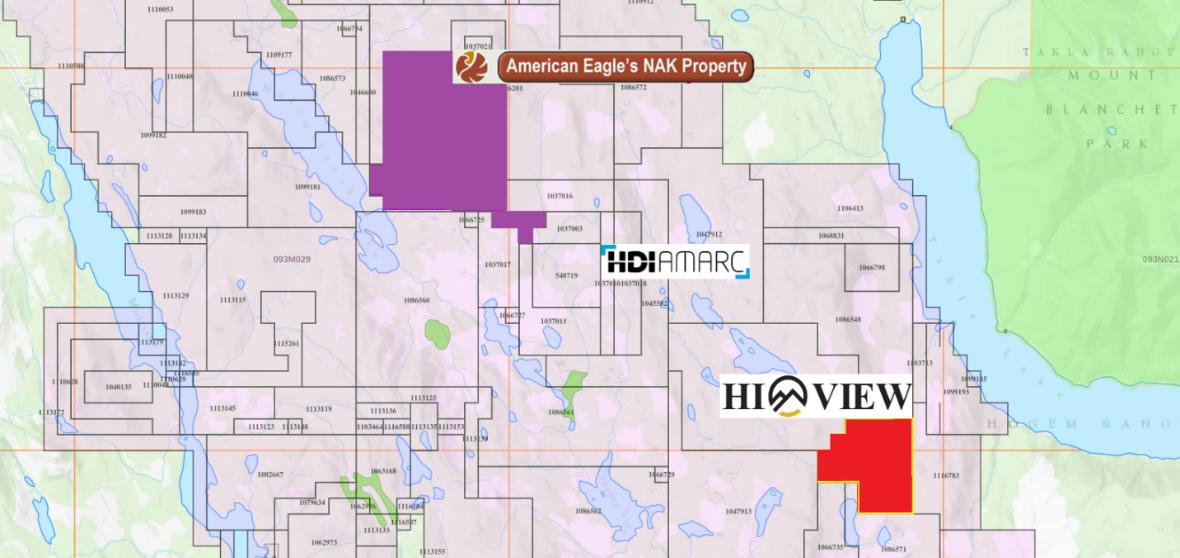

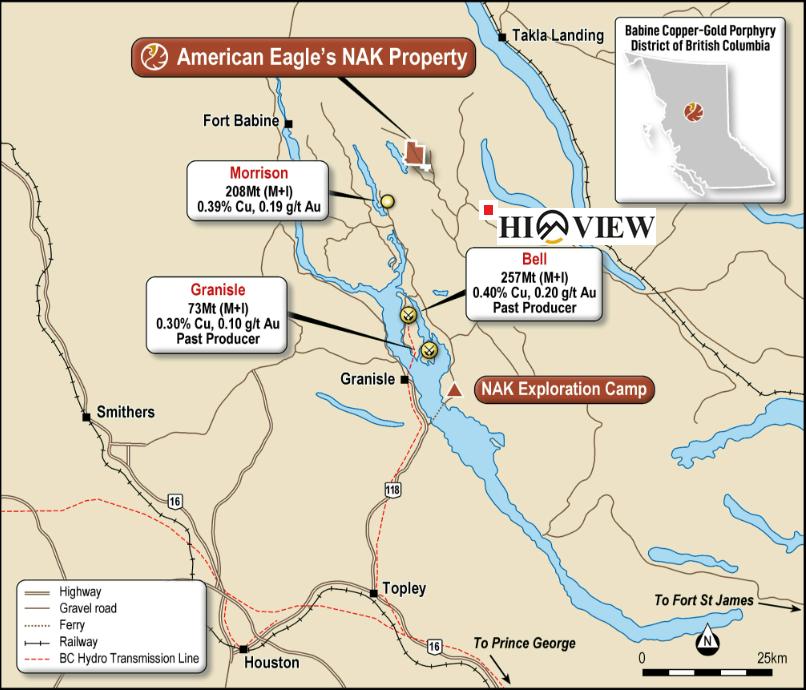

Established industry leaders, along with smaller, high-growth companies, are uniquely positioned to capitalize on this surge. Companies such as Gold Fields Inc. (NYSE: GFI), Kinross Gold Corporation (NYSE: KGC), Barrick Gold Corporation (NYSE: GOLD), IAMGOLD Corporation (NYSE: IAG), Freeport McMoRan (NYSE: FCX), Teck Resources Limited (NYSE: TECK), BHP Group Ltd. (NYSE: BHP), Osisko Mines Inc. (TSX: OSK), Hercules Metals Corp (TSX.V: BIG) American Eagle Gold’s (TSX.V: AE) has over $37 million in cash through significant investments from Teck Resources Limited (NYSE: TECK) and South32 Ltd. (ASX: S32) and believes this near-surface high-grade gold and copper resource will be vital to unlocking the economic viability of the NAK project, in British Columbia, Canada. Hi-View Resources Inc. (CSE: HVW) (OTC: HVWRF) has just acquired a highly prospective mineral claims package spanning over 609 hectares, located in the “Babine” Copper-Gold district of central British Columbia, approximately 12 kilometers to the southeast of American Eagle Gold’s (TSX.V: AE) “NAK” Property that recently announced a significant expansion of its at-surface high-grade gold zone as well as multiple significant drill intercepts. Confirmation of high-grade mineralization extending east of the South Zone, intersecting over 100 meters of 1.11% CuEq from near surface. The new gold zone holes were drilled in different directions, and each returned well over 100 metres of one gram per tonne (g/t) gold equivalent (AuEq) from surface. The results significantly increase the gold zone's size by extending it to depth and to the north. With Hi-View Resources Inc. (CSE: HVW) (OTC: HVWRF) new claims, approximately 12 kilometers to the southeast of American Eagle Gold’s (TSX.V: AE) this positions Hi-View Resources Inc. (CSE: HVW) (OTC: HVWRF) on trend and in a favorable position to make a copper/gold discovery.

American Eagle Gold’s NAK Near Surface South Zone 2024 Drill Highlights:

- NAK24-28 intercepts 101 m of 1.11% Copper Equivalent (CuEq) from 47 m

- NAK24-23: 175 m of 1.03 g/t AuEq from surface

- NAK24-21: 275 m of 0.9 g/t AuEq from surface

- NAK24-19: 108 m of 1.00 g/t AuEq from surface

Hi-View Resources President and CEO Howard Milne states, “With gold prices recently hitting all-time highs and Copper forecasting high demand as a critical metal in the Green Energy Transition, we are excited to add this highly prospective and strategically located property to our Gold and Copper exploration portfolio. These Babine area claims are in proximity to American Eagle’s NAK property that recently announced significant financing from South 32 and Teck Resources, now holding approximately $37-million in cash. The nearby NAK property will undergo a comprehensive drill program to explore the full extent of the system, including the perimeter of the porphyry.”“As well as our new Babine claims acquisition, we are extremely encouraged with the results from our exploration and sampling program at our Golden Stanger property, located in one of the most prolific gold and silver regions in British Columbia, contiguous to Thesis Gold Inc. and we are planning a more extensive 2025 exploration program to follow up on these new anomalous gold zones and test the historic drilling that previously returned drill intercepts of up to 10 meters of 11.5 grams Au.”Hi-View’s Babine area mineral claims are easily accessible from the mining Town of Smithers, located approximately 90 km to the Southwest and connected via highway and rail to major BC ports. The property exhibits favorable topography and significant infrastructure in place leading to low-cost exploration. The nearby NAK property stands out among Canadian copper-gold porphyries with its scale, near-surface high-grades, accessibility, favorable topography, and growth potential. American Eagle Gold has over $37 million in cash with two Major Mining Companies as strategic equity partners – South32 & Teck Resources and will be actively drilling and developing their NAK property.A review of the regional historical data and geological studies of the area highlights from Hi-View Resources Inc. (CSE: HVW) (OTC: HVWRF) new claims demonstrate its potential for mineral exploration. Historical work includes regional government surveys including aerial geophysics, and surficial sampling. Two government geophysics surveys were flown over this area, the 2016 Search Phase ll airborne magnetic and radiometric surveys and the 2008 Quest-West Project airborne electromagnetic and gravity surveys. The claim package sits on the eastern edge of Block 1 of the Quest-West Survey and only one flight line passes through the claim, search Phase ll is higher detail and provides useful information on the regional context of the claim.There are two surface sampling datasets that cover this area. The 2008 Quest-West Project included the collection of new and re-analysis of historical stream and sediment samples. In 2009, archived till samples from the 1995 NATMAP program were re-analyzed due to advances in analytical instrumentation.

Add Hi-View Resources Inc. (CSE: HVW) (OTC: HVWRF) to your watch list for early-stage exposure to some of British Columbia’s best Copper and Gold mining jurisdictions. Two highly prospective Copper and Gold exploration projects next to and near by established deposits. Hi-View Resources Inc. (CSE: HVW) (OTC: HVWRF) Currently trading under a $1million market cap in active 2025 mining camps. Neighboring American Eagle Gold’s (TSX.V: AE) has over $37 million in cash through significant investments from Teck Resources Limited (NYSE: TECK) and South32 Ltd. (ASX: S32). Hi-View Resources Inc. (CSE: HVW) (OTC: HVWRF) upcoming 2025 exploration programs with Gold and Copper discovery potential

Disclaimer:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Free Market Media (“FreeMarket”) was not paid a fee by Hi-View Resources Inc. There may be 3rd parties who may have shares of Hi-View Resources Inc. and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of Free Market owns shares of Hi-View Resources Inc. FreeMarket reserves the right to buy and sell and will buy and sell shares of Hi-View Resources Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by FreeMarket has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.