-

Financial Position: Tango Therapeutics Inc (NASDAQ:TNGX) ended 2023 with a robust cash position of $337 million, expected to fund operations into late 2026.

-

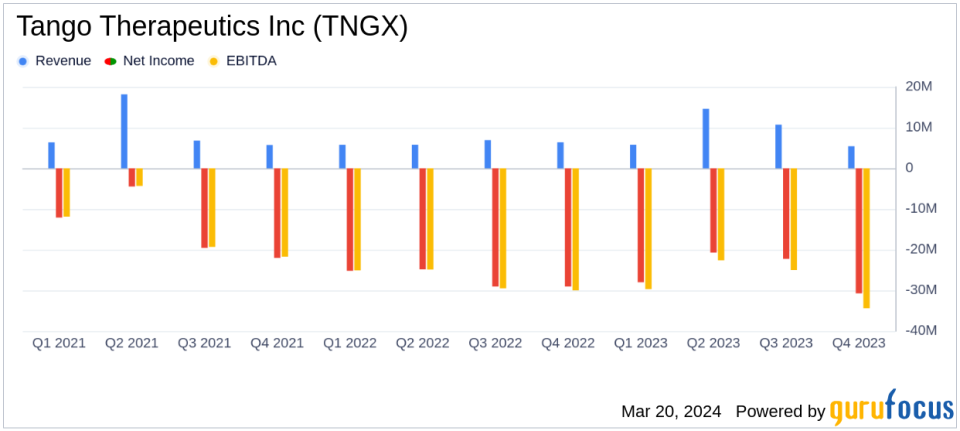

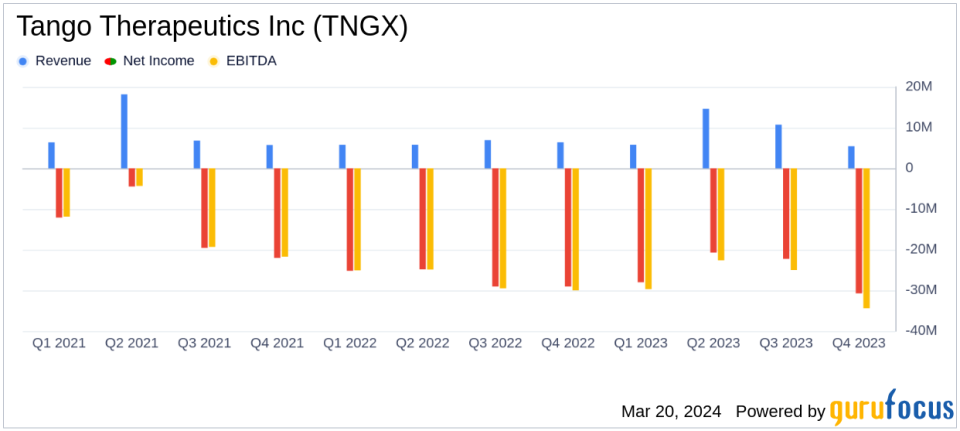

Revenue: Collaboration revenue for Q4 2023 was $5.4 million, down from $6.4 million in Q4 2022, with full-year revenue increasing to $31.5 million from $24.9 million year-over-year.

-

Net Loss: Q4 2023 net loss was $30.8 million, or $0.32 per share, an improvement from a net loss of $29.1 million, or $0.33 per share, in Q4 2022.

-

R&D Expenses: Research and development expenses increased to $31.3 million in Q4 2023, up from $29.1 million in the same period last year.

-

Operational Milestones: Tango Therapeutics Inc (NASDAQ:TNGX) dosed the first patient in the phase 1/2 clinical trial for TNG348 and received FDA Orphan Drug Designation for TNG462.

On March 18, 2024, Tango Therapeutics Inc (NASDAQ:TNGX) released its 8-K filing, detailing the company’s financial results for the fourth quarter and the full year ended December 31, 2023. The biotechnology firm, which focuses on precision oncology treatments, reported a strong cash position and progress in its clinical trials.

Company Overview

Tango Therapeutics Inc (NASDAQ:TNGX) is a clinical-stage biotechnology company dedicated to developing precision oncology therapies. Its pipeline includes TNG908, a PRMT5 inhibitor for MTAP-deleted solid tumors, and other discovery programs such as TNG462, TNG348, and TNG260 targeting various cancer types with limited treatment options.

Financial Performance and Challenges

The company’s financial health is underscored by a strong cash position of $337 million as of December 31, 2023, bolstered by an additional $42 million from an at-the-market (ATM) offering in January 2024. This positions Tango Therapeutics Inc (NASDAQ:TNGX) to fund all clinical programs through proof-of-concept into late 2026. However, the company faces the inherent challenges of the biotechnology industry, including the high costs of research and development, the need for regulatory approvals, and the uncertainty of clinical trial outcomes.

Financial Achievements and Industry Significance

The company’s achievements, such as the FDA Orphan Drug Designation for TNG462 and the initiation of the phase 1/2 clinical trial for TNG348, are significant milestones. These developments not only validate the company’s research but also offer potential competitive advantages in the oncology market.

Key Financial Metrics

Collaboration revenue for the fourth quarter of 2023 was $5.4 million, a slight decrease from $6.4 million in the same period in 2022. However, the full-year collaboration revenue increased to $31.5 million in 2023 from $24.9 million in 2022. Research and development expenses rose to $31.3 million in the fourth quarter, reflecting the company’s investment in advancing its clinical pipeline. General and administrative expenses also increased to $9.1 million in the fourth quarter, up from $7.9 million in the prior year’s quarter. The net loss for the fourth quarter was $30.8 million, or $0.32 per share, an improvement over the net loss of $29.1 million, or $0.33 per share, in the fourth quarter of 2022.

Analysis of Performance

The company’s increased R&D spending is indicative of its commitment to advancing its clinical programs. The management’s commentary, as quoted by President and CEO Barbara Weber, M.D., highlights the strategic progress made in 2023 and the promising outlook for 2024 with expected clinical data from the TNG908 trial. The financial results reflect a company in the growth phase, investing heavily in its pipeline while maintaining a strong cash reserve to support its operations.

For more detailed information on Tango Therapeutics Inc (NASDAQ:TNGX)’s financial results and business highlights, investors and interested parties are encouraged to review the full 8-K filing.

Stay tuned to GuruFocus.com for further updates on Tango Therapeutics Inc (NASDAQ:TNGX) and other value investment opportunities.

Explore the complete 8-K earnings release (here) from Tango Therapeutics Inc for further details.

This article first appeared on GuruFocus.